60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days.

Roll over 401k into simple ira.

Get more flexibility with your investments.

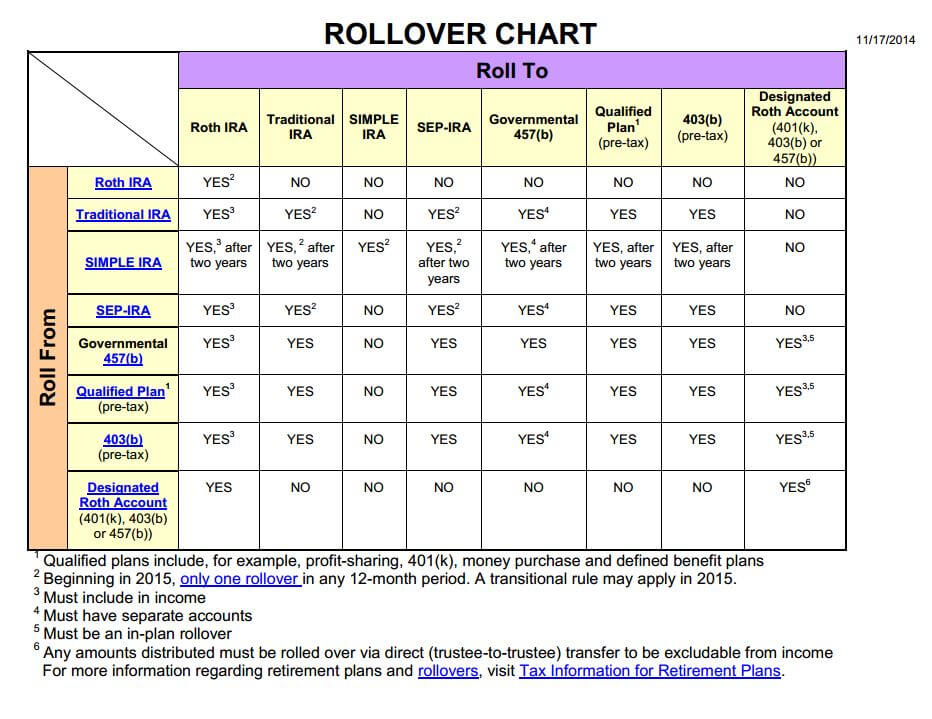

The new law expands portability of retirement assets by permitting taxpayers to roll over assets from traditional and sep iras as well as from employer sponsored retirement plans such as a 401 k 403 b or 457 b plan into a simple ira plan.

Previously a simple ira plan could only accept rollover contributions from another simple ira plan.

Is a 401 k rollover right for you.

Just be sure to check your 401 k balance when you leave your job and decide on a course of action.

If you want to avoid paying taxes wait for two years from the date of plan participation before you carry out the rollover to a 401 k.

Give your money a fresh start by rolling it over into an ira.

That means you move a regular 401 k into a traditional ira and a roth 401 k into a roth ira.

You can legally roll over simple ira assets into a 401 k plan.

However the tax treatment of the rollover will be dictated by the rollover date.

Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution.

You can rollover from a traditional 401 k into a traditional ira tax free.

Same goes for a roth 401 k to roth ira rollover.

Beyond the type of ira you want to open you ll need choose a financial institution to invest with.

What you gain from a 401 k rollover.

Prior to 2016 a simple ira plan could only accept rollover contributions from another simple ira plan.

Roll to roth ira traditional ira simple ira sep ira governmental 457 b qualified plan1 pre tax 403 b pre tax designated roth account 401 k.

A distribution from a simple ira during the 2 year period qualifies as a rollover contribution and thus is not includable in gross income only if the distribution is transferred into another simple ira and satisfies the other requirements of section 408 d 3 for treatment as a rollover contribution.

Simple iras still may not accept rollovers from roth iras or designated roth accounts within 401 k plans.